This week, Metaverse’s new AI’s open-source system attempts to correct gender bias in Wikipedia biographies.

Welcome to The Digital Eye, your weekly roundup of the latest technology news.

Our team of experts have scoured the internet for the most exciting and informative articles so that you can stay up-to-date on all things digital, data, blockchain, AI & analytics.

We hope you find this information valuable and would appreciate your help in sharing it with others who may also be interested.

Polaris teams up with Incited to broaden its data science capabilities

Polaris has announced a new partnership with data science Insurtech, Incited, to broaden its machine learning capabilities offered to its clients.

The new enrichment service is available to Polaris clients using their flagship rating solution, ProductWriter’s Run-Time Environment (RTE), to bring real-time predictive models into its dynamic pricing capabilities.

Incited’s founder and CEO Nick Turner said: “The integration of our machine learning service with ProductWriter is an industry first, demonstrating our joint commitment to enabling advanced features in the Polaris ecosystem. Our long-standing partnership with Polaris continues to deliver value to insurers and brokers. Adding machine learning capabilities to the RTE signals our ongoing commitment to develop and train an increasing number of high-value models for the industry.”

Six Ways to Totally Nail your Fintech Product Launch

Ronen Assia, managing partner of the Tel Aviv-based VC, Team8, gives his insights into new fintech product launches and how to make them a successful

Fintech momentum has fueled an explosion of solutions tailored to niche demographics and new fintech startups are sprouting up on a daily basis.

In fact, it’s only a matter of time before there’s a neo-bank catering solely to aliens in disguise. Yet, success in this space isn’t a foregone conclusion, irrespective of the expanding fintech landscape (and the compelling evidence attesting to the existence of UFOs). In reality, the journey from company ideation to launch must be navigated carefully and is fundamental to the long-term viability of any fintech product.

Six Fintech Trends To Watch In 2022

Despite pandemic-induced delays, 2021 was still a strong year for growth in the financial technology, or fintech, industry. As the world gets used to the “new normal” way of life, what can we expect going forward in fintech?

According to CB Insights’ latest “State of Fintech” report, the third quarter of 2021 was the second-highest on record for fintech financing with an impressive 147% increase year-over-year.

So, what does 2022 hold for fintech? Let’s find out.

1. Embedded finance continues to soar.

Embedded finance, as the name suggests, empowers companies to offer consumers credit without having to leave their platform.

If you’ve ever been shopping online for a high-cost item like furniture, and you’ve seen something like “pay as little as $100/month or 0% APR with Affirm,” you’ve seen—and maybe even taken part in—embedded finance.

Internet of Production: Entering Phase Two of Industry 4.0

The worldwide lab of production is a breeding ground for innovation and cross-domain learning.

Making high-quality gear cannot be learned simply from an Internet search.

You may find guidelines, papers, rules, lectures, and videos. However, applying this general knowledge to a specific production process and dealing with uncertainties and disruptions requires special know-how, most of which resides in people’s heads and networks and is acquired to a large extent through “learning by doing.”

Over ten years ago, the vision of Industry 4.05 was announced at the Hannover Fair 2011 as part of the German/European High-Tech Strategy and adopted internationally by the Japanese Industrial Value Chain Initiative, the Advanced Manufacturing Initiative in the U.S., the Chinese Made in China 2025 strategy, the South Korean Manufacturing 3.0, and the U.K.’s High-Value Manufacturing Catapult research centre.

Role of analytics & big data will become increasingly critical for businesses

Dan Fiehn, Chief Operating Officer at Incited, elaborates on how Incited is accelerating insurers’ digital journeys with their platform IMMERSA365. Read on to know more about his thoughts on the impact of Big Data and navigating complex ESG agenda.

MEDIA 7: Thank you so much for doing this with us! Before we dig in, our readers would love to learn a bit more about you. Can you tell us a story about what brought you to this specific career path?

DAN FIEHN: Firstly, thank you for giving me this opportunity. I am delighted to be taking part in this interview. This is a great first question.

Since I was young, I’ve been interested in technology and how this can be harnessed to solve problems. The launch of the ZX Spectrum in the 1980s inspired me to learn basic computer skills, as many people growing up in the 80s did, which allowed me to acquire fundamental computing knowledge.

I spent hours and hours copying code from weekly computer magazines. Frequently, these never worked, and I had to wait until the following week for the fixes to the bugs to be published. Over time, I learned how to fix these issues myself and eventually write my own programmes. I was fortunate that my college had a computer room that I could use at lunchtimes and after lessons. This allowed me to develop my skills further.

I also joined a computer club where I met like-minded people who encouraged me to pursue a career in IT. Fast forward to today, and I’m proud to say that I’ve been working in IT for over 30 years. I’ve held various roles during this time, from software development to project manager and now lead a team of data scientists as Chief Operating Officer. The thrill of “delivering” a new thing continues to live with me today, albeit the solutions take much longer to deliver and are more complex.

Article by @VentureBeat

By this point, it’s become reflexive: When searching for something on Google, Wikipedia is the de facto go-to first page. The website is consistently among the top 10 most-visited websites in the world.

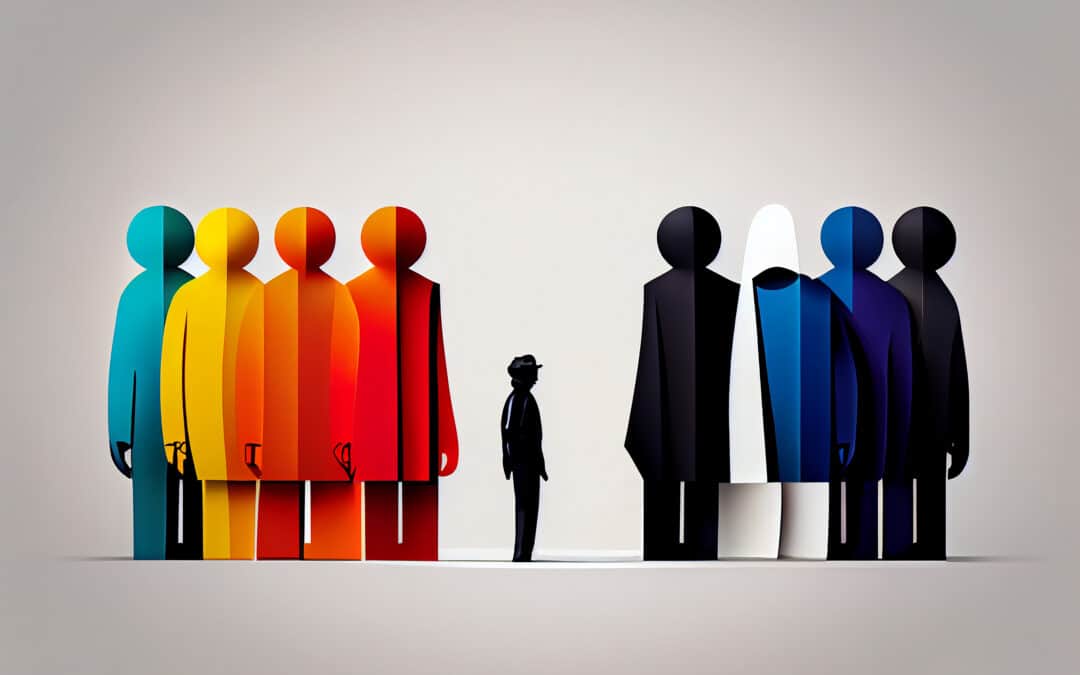

Yet, not all changemakers and historical figures are equally represented on the dominant web encyclopedia. Just 20% of Wikipedia biographies are about women. That percentage goes down even more when it comes to women from intersectional groups — those in male dominated industries like sciences, for example, or from historically underrepresented ethnic backgrounds.

This is indicative of the fact that “there’s a lot of societal bias on the internet in general,” said Metaverse AI researcher Angela Fan, who set out to explore this imbalance for her Ph.D. project as a computer science student at the Université de Lorraine, CNRS, in France. “AI models don’t cover everyone in the world equally.”