Introduction

In the dynamic world of insurance, the claims landscape is undergoing a significant transformation, propelled by the wave of technological advancements that show no signs of slowing down.

As we look towards the future, claims technologies in 2024 are at the forefront of this evolution, promising to revolutionise how claims are managed, processed, and resolved. These innovations streamline operations and elevate the customer experience to new heights of speed, transparency, and personalisation. At the forefront of this revolution are key technological pillars such as Artificial Intelligence (AI), hyper-automation, advanced data analytics, intuitive chatbots, versatile business rules engines, and the interconnectedness of the Internet of Things (IoT).

While the immediate future is bright with these advancements, the potential of nascent technologies like augmented and virtual reality, Non-Fungible Tokens (NFTs), and the expansive realms of the metaverse looms on the horizon, their impact hinging on how quickly society embraces these innovations.

Let’s explore the top claims technologies in 2024 that are set to reshape the insurance claims process in the year ahead.

Contents

PART I

1. Technological Innovations Reshaping Claims Processing

Before we start, let’s take a holistic look at the future of claims processing and the impact of technology.

Every stage of the claims journey, beginning even before an incident takes place, will be enhanced by a harmonious blend of technology and human interaction. This synergy aims to streamline the process, speeding up claim resolutions and significantly improving the customer experience.

The future will be about strategically positioning human interaction where it has the most impact while leveraging technology to augment the efficiency and effectiveness of claims handlers.

This involves reimagining the claims process to offer customers more choices, ensuring that their experience is not just satisfactory but truly exceptional, marked by personalised and meaningful human engagement.

In contrast, innovation goes beyond problem-solving. It involves actively seeking new possibilities, exploring uncharted territory, and devising fresh approaches to create breakthroughs. Innovation strives to transcend the existing norms and generate novel solutions that bring about substantial improvements.

The insurance sector is focusing on harnessing data to deepen insights into risk and customer behaviour, aiming to boost efficiency and agility. There’s also a strong push towards embracing advanced automation, moving beyond essential technologies to implement a results-driven approach with various automation tools.

Preparing for a more interconnected insurance future is another priority, involving significant investments in APIs, exploring open API possibilities, and modernising core systems to lay a solid foundation for innovation. These strategic efforts are crucial to positioning insurers for success in a rapidly changing industry landscape.

Gartner predicts that leading insurers will adopt a customer-centric strategy by integrating customer and societal ecosystem insights. This will involve applying comprehensive personalisation to align insurance products with customer needs better, ensuring a more tailored and relevant experience for everyone.

2.1. Artificial Intelligence (AI)

While Artificial Intelligence (AI) ignites excitement for its transformative potential, its adoption in customer-facing roles within the insurance sector remains cautious. This hesitation largely stems from the vagueness of existing regulatory landscapes, which poses a challenge to insurers eager to leverage AI’s capabilities fully.

AI and Machine Learning (ML) stand out for their unparalleled ability to sift through and categorise extensive data sets, from claim documents and images to historical records. This capability underpins AI and ML’s most significant contribution to claims processing: the power of data-driven decision-making. This analytical prowess opens the door to more accurate, efficient, and informed claims handling.

The areas where AI will likely make the most significant impact in claims management include verifying accidents and damages, ensuring information accuracy, performing completeness checks, detecting fraud, intelligently assigning claims, and aiding in loss prevention. Moreover, innovative insurers are venturing into “human-in-the-loop” scenarios, where AI-based assistants, such as GenAI co-pilots or co-bots, augment the productivity and expertise of human workers, enriching the entire business ecosystem.

Forward-thinking insurance companies also harness AI to forecast claim trajectories and tackle the underlying factors of claim cost inflation. Such predictive capabilities are poised to substantially boost the productivity and efficacy of loss adjusters by providing nuanced decision support tailored to the complexity of individual claims.

The opportunity for AI to elevate insurers’ value propositions and markedly enhance customer experiences cannot be overstated. In a fiercely competitive landscape, the strategic use of AI differentiates insurers and redefines customer engagement and satisfaction standards. As the industry evolves, the insurers who navigate the regulatory maze and embrace AI’s full spectrum of possibilities will undoubtedly lead the pack, setting new benchmarks for innovation and service excellence.

2.2. Hyperautomation

In the dynamic landscape of the insurance industry, there’s a growing trend towards bolstering efficiency and augmenting human capabilities through advanced automation. Insurers now engage with vendors who skilfully merge time-tested solutions such as business process management (BPM) and robotic process automation (RPA) with cutting-edge AI and sophisticated algorithms. This synergy automates routine processes and transactional steps more effectively and paves the way for hyperautomation.

Hyperautomation represents the next frontier in refining, accelerating, and revolutionising insurance processes, offering an unparalleled leap in operational efficiency.

A particular focus for many insurers, especially within the Property and Casualty (P&C) sector, is streamlining claims processing through straight-through processing techniques. This strategy becomes indispensable when the volume of claims is high but the individual claim values are relatively low. It ensures the claim’s handling process is speedy and efficient, positively impacting customer satisfaction.

Moreover, the role of intelligent document processing in boosting operational productivity across underwriting, claims, and supply chain management cannot be overstated. This technology is critical for extracting and analysing essential information from semi-structured and unstructured data, offering insights that were previously difficult to harness.

The adoption of visual intelligence solutions marks another innovative stride forward. Insurers encourage policyholders to submit images and videos of incidents or damages directly through smartphone apps. This approach significantly speeds up the claims process and facilitates real-time, remote collaboration between claims adjusters and policyholders. It ensures accurate property damage documentation and drastically reduces the need for on-site visits, saving time and reducing costs.

As insurers navigate the complexities of modernising their operations, integrating these technologies is not just enhancing existing workflows. It’s transforming the very fabric of the insurance industry, making it more agile, responsive, and attuned to the evolving needs of today’s digital-first customers.

Close to 90% of insurance customers say that claims processing efficiency influences their loyalty to their insurer – Forbes

2.3. Data Analytics

The digital revolution has allowed the insurance sector to harness vast datasets, revolutionising pricing, coverage, and risk assessments. When adeptly analysed and applied, this wealth of data is the cornerstone of a more nuanced and informed approach to claims management.

At the heart of this transformative journey is effectively deploying data and insights to inform and guide claims decisions. The advent of cloud-based data platforms has significantly streamlined this process, marking a pivotal shift towards efficiency and accessibility.

The development of logical data warehouses, or data fabric technology, has simplified the management and governance of data, making it more readily available for analysis. This progress is crucial, especially as AI and machine learning models become increasingly integral to the insurance industry, enhancing the capability for insightful decision-making.

Data management and analysis evolution leads to more intelligent and expedited decision-making processes, offering tangible benefits to insurers and policyholders. The industry stands on the cusp of further breakthroughs, with the potential for seamless integration of new and real-time data sources from connected devices. Such integration promises not only to streamline the claims process but also to advance loss prevention strategies significantly.

Moreover, the adoption of remote assessment technologies is set to redefine the landscape of claims management. Virtual inspections enabled by these technologies will improve decision-making accuracy, ensuring that assessments are swift and precise. This forward-looking approach underscores the insurance industry’s commitment to leveraging technological advancements to enhance operational efficiency, customer satisfaction, and overall resilience against future challenges.

2.4. Chatbots

The moment a customer files a claim is pivotal to their satisfaction and perception of their insurer. Claims, fundamentally, are the primary service insurers provide, and optimising the customer experience during this process is crucial for securing loyalty and trust. Enhancements in this domain can significantly impact overall customer satisfaction and, when implemented effectively, can substantially benefit insurers and their clients.

The integration of predictive chatbots into self-service channels is set to redefine the claims experience. These advanced systems, backed by automation technologies, not only expedite the claims handling process but also enrich the data quality and minimise the need for manual intervention. This innovation allows for a more personalised claims journey, offering timely support to customers when they need it most.

Gartner highlights the transformative potential of conversational user interfaces for the insurance industry, underlining several key advantages:

• Efficiency Enhancements: By augmenting human capabilities and automating routine tasks, these interfaces can streamline operations in employee-facing scenarios, allowing staff to focus on more complex issues.

• Natural-Language Interaction: The ability to interact with business applications through natural language, whether by text or voice, drastically improves the speed and ease with which claims handlers can navigate systems and respond to customer queries.

• Operational Agility: During peak times, conversational interfaces can significantly accelerate processing and shorten response times, ensuring that customer inquiries are addressed promptly and efficiently.

The future of insurance claims processing is poised for a shift towards greater efficiency, personalisation, and user satisfaction. By embracing conversational user interfaces and the broader spectrum of automation and AI technologies, insurers can offer their customers a more responsive, engaging, and seamless experience, setting a new standard in the industry.

2.5. Business Rules Engines and APIs

Exploring the transformative potential of business rules engines in claims processing reveals a landscape ripe for innovation.

Fusing business rules engines with APIs marks a transformative advancement for the insurance sector. This integration transcends mere operational efficiency improvements; it’s a strategic pivot towards greater agility and heightened responsiveness within a swiftly evolving marketplace.

Such technological integration empowers insurers to navigate new regulations swiftly, align with shifting customer expectations, and address emerging risks, all while bypassing the need for complex coding or lengthy IT endeavours. This approach streamlines processes and significantly accelerates the industry’s ability to adapt and innovate.

Numerous insurers find themselves burdened by legacy systems that, despite their stability, act as barriers to innovation. The strategic pairing of business rules engines with APIs provides a crucial pathway for these companies to modernise their operations. This combination facilitates the rejuvenation of their processes, enabling a seamless transition into modern practices without overhauling their foundational systems entirely.

It offers an innovative, efficient solution to embrace new capabilities while retaining the core strengths of their existing infrastructure.

The insurance industry is evolving into a more interconnected ecosystem, where enhanced collaboration and data sharing among partners are pivotal in amplifying customer value. Insurers can use business rules engines to forge a unified platform that simplifies claims processing and elevates the customer experience by offering a broader spectrum of services and engagement points. This strategic integration allows for a more seamless, efficient, and customer-centric approach to insurance, setting new standards in service delivery and customer satisfaction.

The advantages highlight the transformative power of business rules engines in enhancing the speed and precision of claims processing, thereby revolutionising the insurance sector’s stance on innovation, collaboration, and customer care. This underlines the belief that harnessing the capabilities of these engines could serve as a significant turning point, symbolising a critical phase in the technological evolution of the insurance industry.

2.6. Internet of Things (IoT)

The Internet of Things (IoT) is a cornerstone in the insurance industry’s journey towards digital transformation. IoT has unlocked valuable data through various connected devices, including wearables, smart home appliances, vehicle telematics, and medical devices. This influx of real-time, granular data offers unparalleled insights into user behaviour, risk assessment, and preventative strategies, significantly enhancing the precision of insurance models.

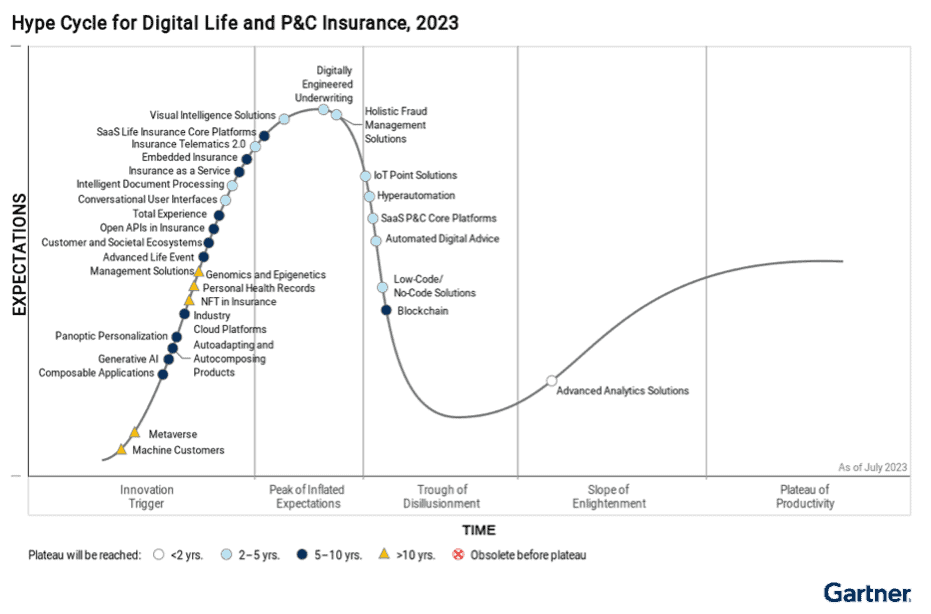

Gartner has recognised IoT’s profound impact, positioning it at the zenith of its influence on the industry. Yet, the horizon promises even more ground-breaking advancements. Integrating satellite data and advanced sensor technologies is poised to revolutionise our understanding of infrastructure and community environments. These innovations are expected to pave the way for creating detailed digital twins—virtual replicas of physical entities.

Such advancements promise to refine risk models with more accurate simulations and to bridge the protection gap more effectively. By offering a more nuanced understanding of risk factors and potential impacts, insurers can develop more robust protection mechanisms tailored to the nuanced needs of diverse communities.

This evolution in IoT’s application within the insurance sector underscores a shift towards more proactive and predictive insurance models, emphasising prevention and precision. The potential to narrow the protection gap through advanced simulations and digital twins represents a significant leap forward in our ability to safeguard and enhance the resilience of communities against emerging risks and challenges.

PART III

3. Beyond the Next Five-Year Horizon

At the heart of this digital renaissance is the metaverse, a concept still in its embryonic stage yet poised for explosive growth. Forecasters are betting on its potential, envisioning a future where 15-33% of global digital transactions could migrate to this immersive virtual universe. With projections placing its market value between $8 to $13 trillion by 2030, the metaverse is anticipated to redefine the essence of digital interaction through a blend of spatial computing and the seamless integration of virtual experiences with our physical reality. This new digital frontier is underpinned by cutting-edge technologies such as blockchain, cryptocurrencies, AI, NFTs, and AVR, promising a transformative impact across industries.

Yet, the journey of technological evolution teaches us caution. The initial enthusiasm surrounding innovations like blockchain serves as a reminder that the path to widespread adoption can be fraught with challenges. Despite its once lofty expectations, blockchain has encountered setbacks, from consortium breakdowns to the unrealised potential of various applications.

The trajectory of these digital breakthroughs will ultimately hinge on their acceptance and integration into the fabric of society. While expecting a seismic shift within the next five years may seem premature, the seeds of change have been sown. The pace at which these technologies gain traction will dictate their influence on the business world and beyond.

As we navigate this speculative phase, we must watch the unfolding narrative of AVR, NFTs, and the metaverse. Their collective journey represents technological progress and a reimagining of how we connect, transact, and experience the world around us. The potential for transformation is immense, yet the adoption curve will ultimately chart the course of these digital pioneers.

Conclusion

2024 marks a defining moment in insurance claims, propelled by technological breakthroughs aimed at streamlining the claims process, enhancing transparency, and improving customer interactions.

As these technologies continue to mature and integrate, we can expect a profound transformation in how insurance claims are handled, fundamentally altering the dynamic between insurers and policyholders.

For professionals within the insurance sector, keeping pace with these developments will be crucial for successfully navigating the evolving claims management landscape.