Introduction

Technology is changing the way that insurance companies do business.

In the past, IT has been used to cut costs across the organisation. But now it’s about how new technology can help grow and engage with customers more than ever!

What are the 4 main areas of digital transformation in the insurance industry in 2023? We will see the core areas to be:

· Customer experience

· Data and analytics

· Business model transformation

· Digital operations

This blog post will explore these areas in detail and discuss how businesses can prepare for the coming changes.

Contents:

-

What is digital transformation, and why do you need it

-

The four biggest areas of digital transformation in the insurance industry

-

Customer Experience

-

Data & Analytics

-

Business Model Transformation

-

Digital Operations

-

What challenges will businesses face?

-

How to prepare for successful digital transformation?

-

Other digital technologies to watch

-

Conclusion

1. Terms frequently used in this post

2. References

PART I

What is digital transformation, and why do you need it?

Before we start, what is meant by digital transformation?

Digital transformation is the term used to describe when technology is used to create new or improved business processes, products, and services. It can improve customer experience, increase operational efficiency, and drive new revenue streams.

In the insurance industry, digital transformation strategies are essential to remain competitive and meet customers’ changing needs.

The four biggest areas of digital transformation in the insurance industry

1. Customer Experience

The customer experience will continue to be a top priority for insurers as they look to improve retention and attract new customers.

Positive Engagement

In 2023, businesses will need to focus on creating a positive and engaging experience for their customers, regardless of whether they buy insurance online or through a traditional broker. This means providing a smooth and easy purchase process, as well as offering valuable features and services that go beyond just coverage.

In addition, businesses will need to focus on developing strong relationships with their customers and providing personalised services that meet their needs. By doing so, businesses can create loyal customers who are more likely to recommend them to others.

Self-Service Capabilities

To stay ahead of the curve, insurers must provide modern solutions and improve self-service capabilities.

Cognitive computing will enable Insurers to offer customers a digital experience beyond simply processing claims or managing policies.

This cutting-edge technology can provide customers with tailored product recommendations based on their preferences.

Even processes traditionally completed offline, such as physical signatures and medical underwriting, are now transitioning to digital processes with the help of technology like legally binding eSignatures.

Moreover, compliance can now be automated to the point where insurers can use audit trail reports to detect infractions before they happen. Plus, digital data can be effortlessly converted into reporting suites for storage and future audits.

Personalised Products

As customer expectations rapidly increase, insurers must be able to meet their needs efficiently and effectively. In 2023, digital technology and customer experience are expected to play a major role across all insurance segments as customers demand more personalised services that can be provided through mobile devices rather than traditional call centres.

Artificial Intelligence

AI is changing how companies interact with customers for several reasons: firstly, chatbots can quickly process information, which helps insurers provide customers with immediate answers. Secondly, AI can help identify customer needs and preferences, which allows businesses to tailor their products and services accordingly.

Finally, AI-enabled chatbots can handle multiple conversations simultaneously, providing a more efficient way for businesses to communicate with their customers.

In 2023, more insurance providers will offer AI-driven bots on their websites and mobile apps. More and more businesses will adopt behavioural science techniques to nudge customers into the most natural support channel given their current context to reduce customer effort and solve problems more quickly.

By providing customers with a quick and easy self-service experience through these automated interfaces, insurers can lower costs and increase retention rates whilst improving customer engagement.

2. Data and Analytics

Data and analytics have always been important in the insurance industry, but they will become even more critical in 2023 as economic conditions worsen.

By doing so, they can stay ahead of the competition and continue to grow their business. Understanding their customers better through data will allow for more personalised experiences.

Data Enrichment

Data enrichment will play an important role in digital transformation in 2023. This process includes ingesting data from external sources to supplement internal customer data. By doing so, businesses can get a more complete picture of their customers and the market. They can use this information to make better products, services, and operational decisions.

Expect to see Data companies furthering their integration with the market and offering new data sets providing a deeper understanding of customers.

Synthetic Data

In 2023, artificially generated data to simulate real-world data (synthetic data) will become increasingly important. This is because synthetic data can be used to improve the accuracy of AI models and test new products before they are launched. As a result, businesses that use synthetic data can save time and money while getting their products to market faster.

Digital Twin

Digital twin models will continue to grow in popularity. A digital twin is a digital replica of a physical object or system that can simulate how the object or system would respond to various conditions. This information helps improve decision-making about the design, production, and operation of the object or system.

Artificial intelligence

In 2023, Artificial Intelligence and analytics will become increasingly present as it is embedded into work applications, vehicles, and personal devices of major companies such as Microsoft, Salesforce, Apple, Google, and Amazon. As machine learning processes become more sophisticated, they will understand our behaviour better and make intelligent suggestions for what we buy and how we work.

3. Business Model Transformation

In 2023, “business model transformation” will become increasingly important in the insurance industry.

For an excellent example of domain transformation at work, look no further than Amazon, which has recently expanded into a new market domain with the launch of the Amazon Insurance Store.

Further, well-cited examples include Apple’s reinvention of music delivery or Netflix’s transformation of video distribution.

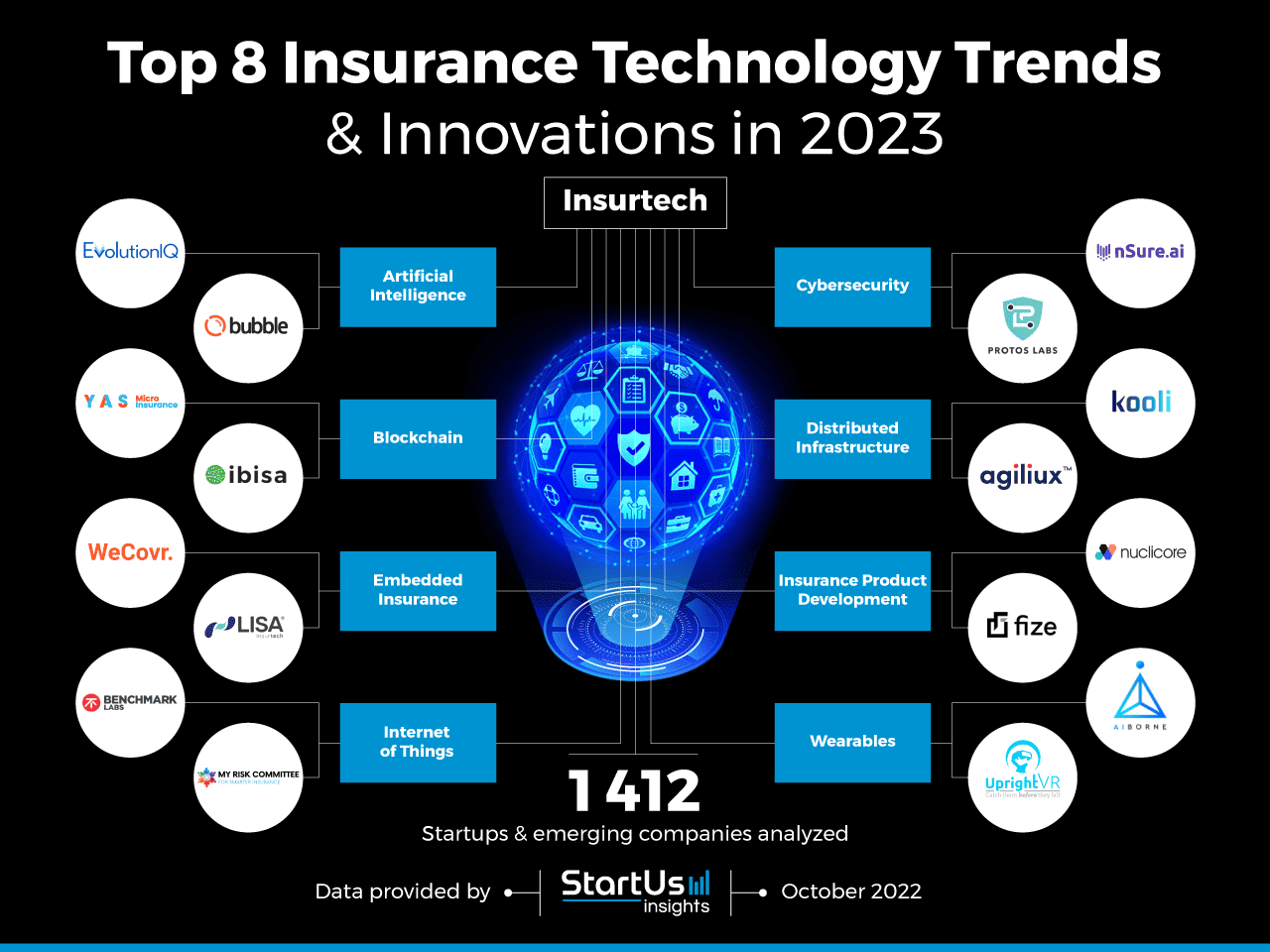

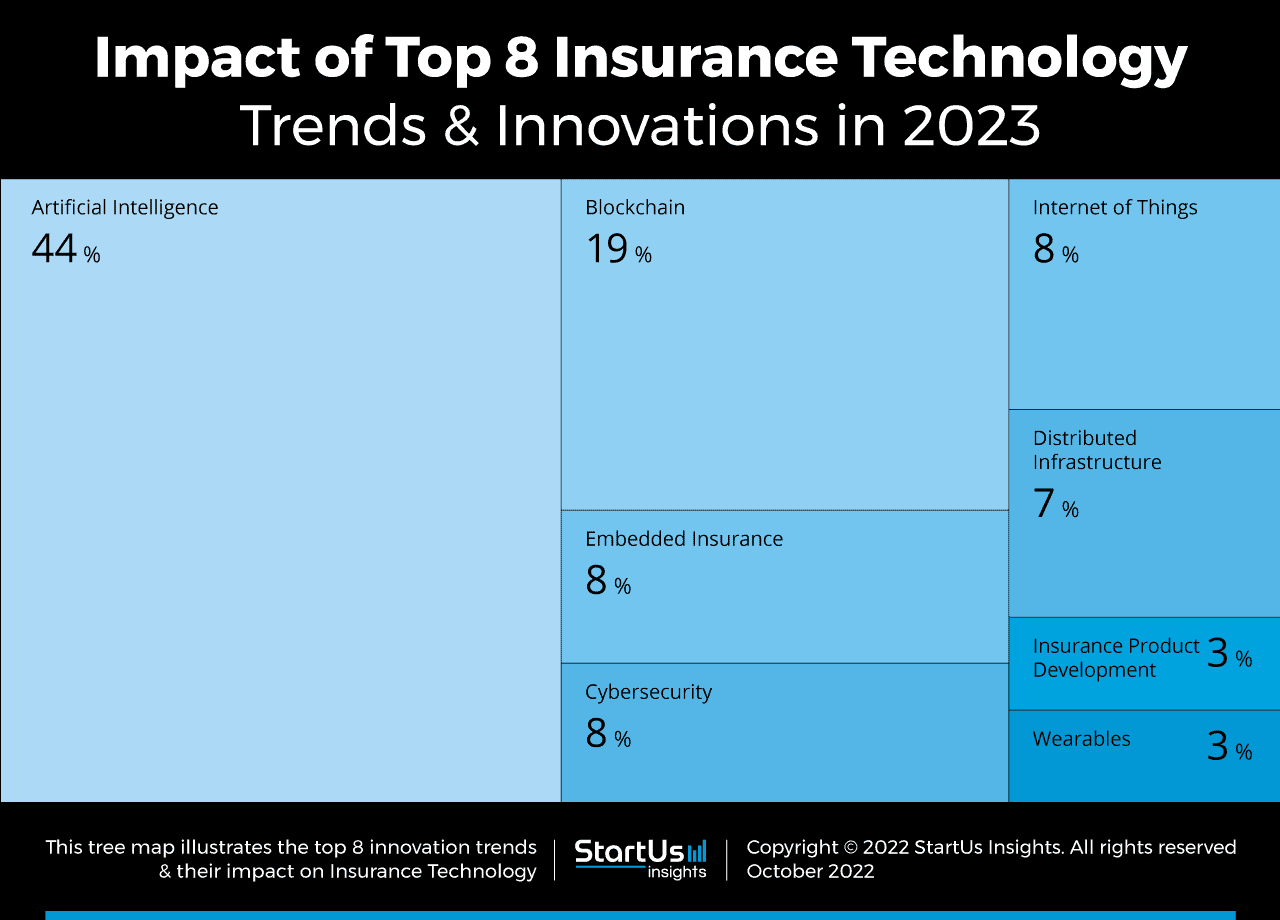

Insurtechs

2023 is set to be a period of economic uncertainty, and consequently, businesses must be willing to change with their customers’ needs to stay ahead of the competition. There’s no doubt in my mind that we’ll see more and more Insurtechs coming to the fore, offering a range of imaginative, unique pay-as-you-go, usage-based, and on-demand products to meet specific needs.

These start-ups are using technology to improve the affordability and accessibility of their micro-insurance services. By doing so, these companies can reach a wider range of customers and penetrate new markets more quickly than traditional insurers.

Embedded Insurance

Embedded insurance products will become more common in 2023 as businesses look for new ways to distribute their products and reach new customers. By coupling insurance with other products or services, Insurers can access new markets, increase revenue, and simplify customer buying.

In 2023, businesses will continue collaborating with other organisations to provide more holistic options for their customers.

4. Digital Operations

In 2023, digital operations will be critical for success and underpin the previously discussed three areas.

This shift entails ditching manual task-based processes in favour of automated, intelligent, end-to-end digital solutions.

Improving your company’s bottom line is simple: have employees work on tasks that will help the business grow instead of spending time and resources on monotonous, repetitive activities which add minimal value.

Robotic process automation will continue to be in the spotlight in the upcoming year as driving growth becomes more important than ever.

Decision Intelligence

Decision Intelligence is fast becoming a popular approach that helps businesses address specific problems using data science techniques, and this trend is expected to gather pace in 2023. Rather than AI technologies triggering wide-scale digital transformations, Decision Intelligence provides the commercial application companies can use to automate processes and scale their Data Science capabilities across operations.

With this tool, those in charge can make decisions more quickly and efficiently. Therefore, the company can improve its decision-making process leading to better business outcomes.

Hybrid Working

In the following year, hybrid working will evolve further and be at the forefront of organisations as they allow employees to have a more flexible working environment. Leading collaboration software will continue to develop, with increasingly new features to ensure everyone can collaborate easily, no matter where they are.

Collaboration is about more than just meetings and events–it’s about shared experiences. Beyond 2023, expect our engagements to be made richer by Artificial Intelligence, the Metaverse, and 5G connectivity.

Organisations want to use their infrastructure in the best way possible by utilising what is available at a lower cost—especially during difficult economic times. After the significant movement towards hybrid cloud infrastructure in 2022, 2023 will bring an even greater focus on multi-cloud computing.

Cloud computing

Public cloud players have made their offerings more extensible over the last few years, offering that desired flexibility, scalability, compliance, and other favourable multi-cloud challenges. This will continue as providers offer more open-source solutions and modular offerings, making it easier to orchestrate workloads across the IT environment.

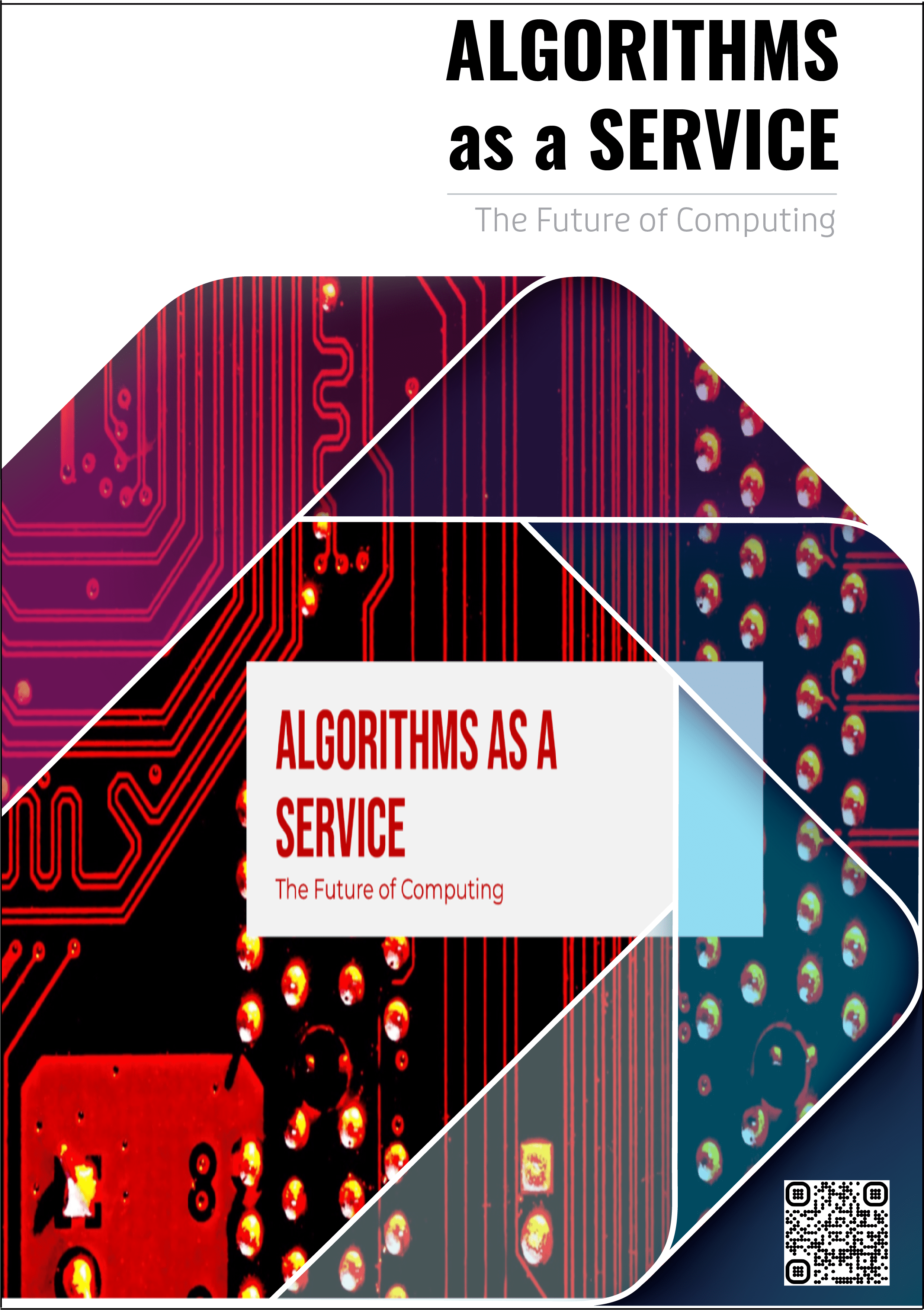

Algorithms as a Service: The Future of Computing

Algorithms as a Service represent a new category of software that allows you to use pre-built algorithms without developing and maintaining them. This article will explore algorithms as a service and how they will change how businesses operate.

Everything as a Service

With an impending recession on the horizon, and organisations cutting back on spending, we will see more solutions delivered as a service. Everything as a Service, or XaaS, will soon become familiar terminology. This cloud evolution will allow businesses to reduce costs, improve efficiency, provide flexibility, and quickly adapt to market changes. The ability to scale up and down as needed will appeal to companies struggling with reduced revenue.

Low-code & No-code

Low-code and no-code solutions will be a focus in 2023 due to their ease of integration into any organisation’s existing technology environment. Low-code and no-code solutions provide an efficient way for Insurers to build and launch new products quickly. By streamlining processes across the operations, such solutions enable organisations to do more with fewer resources and greater efficiency.

PART II

What challenges will businesses face?

Insurers will encounter a few hurdles as the insurance industry responds to changing market conditions in 2023.

The importance of a strong digital strategy will become ever more apparent to keep up with rapidly changing customer expectations. Non-traditional competitors, such as Amazon, which is expanding into a new market domain with its new Insurance Store, may continue to break down industry boundaries, unbundle insurance contracts, and rapidly introduce new technologies and areas of digital innovation.

Lastly, cybersecurity will continue to be paramount to ensure Insurers have the proper levels of protection.

Although companies will face challenges, they can set themselves up for success by being aware of these potential obstacles and taking steps to prepare for them.

How to prepare for successful digital transformation

Businesses should start preparing for a digital transformation project now by doing the following:

1. Assess your current state:

Take stock of your business processes, systems, digital technologies, and data to identify improvement areas.

2. Define your goals:

What do you want to achieve with your digital transformation efforts? Do you want to improve customer engagement, drive operational efficiency, or develop new revenue streams?

3. Create a digital transformation strategy:

Once you have defined your goals, you need to create a comprehensive digital transformation strategy for how you will achieve your goals. This should include a timeline, budget, and needed resources.

4. Implement digital technology:

You must implement new or improved technology solutions to support your digital transformation journey.

5. Train your employees:

Digital transformation initiatives will require changes to employee roles, responsibilities, and skillsets. Ensure you provide training and support to help them transition to their new roles.

Other digital technologies to watch

IoT

The internet of things (IoT) is an area that is constantly changing. IoT involves connecting physical devices and sensors to the internet. This allows businesses to collect data about their customers and products, which they can use to make changes within their company. By generating accurate and real-time data, IoT provides the key to unlocking new usage-based insurance products. Coupled with Edge Computing and Computer Vision, IoT platforms are set to become increasingly relevant to the insurance sector.

5G

5G is the next level for wireless technology in terms of speed and capacity. With the rapid pace of 5G, you can stream videos or play games without buffering or lag. Additionally, 5G will allow the full potential of IoT devices as outlined above, as it supports billions of devices simultaneously without compromising speed or reliability. In the insurance domain, 5G can be used to better the speed and accuracy of data gathering. 5G will also allow businesses to present innovative services, such as real-time customer behaviour analysis.

Blockchain

Blockchain’s impact on the insurance industry has been contained but will gradually become more substantial. In 2023, we will see progressively creative firms invest in blockchain technology as it can be used for many applications, such as ensuring data safety with tokenisation and reducing operational costs by simplifying supply chain management with smart contracts.

Wearable devices

With the increasing popularity of fitness trackers and smart homes, people are also beginning to demand that their insurance companies support them with integrated solutions.

The data and analytics collected from wearables and remote sensors will help insurers better anticipate risks and refine their processes. In 2023, the focus will be more on big data and advanced analytics to provide accurate forecasts of policyholders’ needs.

Quantum Computing

Quantum Computing is an emerging technology far from production-ready but promises a paradigm shift in digital disruption.

Conclusion

Insurers who want to control costs, increase company growth and maximise business value must prioritise digital transformation as the economy takes a downturn in the next few years.

The four biggest areas of digital transformation in 2023 which offer significant opportunities for better business performance will be customer experience, data and analytics, new business models, and digital operations.

To prepare for a company’s digital transformation, technology leaders should assess their existing business processes, define their goals, create a roadmap, implement digital solutions, and train their employees. Businesses that can change will be well-positioned for success in 2023 and beyond. However, those who do not embrace change may struggle to keep up with the competition and increase customer expectations.

By understanding and preparing for these four areas of transformation, your business can stay ahead of the curve. It is an exciting time to be in Insurance and technology.

What do you think will be the most important area of digital transformation in 2023? I’d love to hear your thoughts.

Don’t forget to follow us on social media for more insights into digital transformation!

What impact do you think Decision Intelligence will have on your business?

PART III

Terms frequently used in the post

What are algorithms?

An algorithm can be defined as instructions for solving a problem or accomplishing a task. There are various types of algorithms, which can be broken down into different categories.

Artificial intelligence algorithms are a subset of algorithms that have been specifically designed to simulate or perform human-like tasks.

Types of algorithms

Supervised algorithms are named as such, as they are given data that has been labelled upon which to “learn”. The algorithms iteratively make predictions and then are adjusted to the correct answer using this training data. This means the algorithm becomes optimised to know the right solution for each data item it processes.

Supervised learning is like learning from a textbook. The algorithm learns from training data and then applies that knowledge to new data. Supervised learning models are typically more accurate than unsupervised ones but require human intervention to label the data.

An example of a supervised algorithm would be a model that can predict how long your car journey will be based on the time of day. But first, this model needs training to know that rainy weather will likely extend the driving time.

Unsupervised algorithms are given unlabelled data from which to learn. The algorithm works independently to discover hidden patterns or groupings within the data.

Unsupervised learning is like learning from experience, and they make an ideal solution when exploring data or making recommendations.

Such algorithms have many advantages, but there are some risks. To avoid biased outcomes, AI developers must rely on human verification to decide what is reasonable. Transparency into why specific associations have been made is crucial as unsupervised algorithms can provide little insight into how they reached conclusions about the data.

An example of an unsupervised algorithm would be a model that can identify the behaviours of online shoppers who often purchase groups of products simultaneously. However, to show whether it makes sense to combine paper with an order of pens, pencils, and erasers, you need to validate that it makes sense.

Semi-supervised algorithms use data that is only partially labelled. In this scenario, the algorithm uses labelled data to learn and fill in the gaps of the rest of the unlabelled data. Using a semi-supervised algorithm is that it can make informed assumptions based on the labelled data.

This algorithm is widely used in image recognition, where much of the data is unlabelled. The algorithm can learn how to classify objects by referencing pictures that have been correctly labelled and categorised. It can also learn to recognise objects in photos that have not been tagged.

The cost to label data appropriately is often high due to the expertise and time required. So, semi-supervised or unsupervised algorithms can be a more appealing alternative without fully labelled data.

What is machine learning?

Machine learning is a term used to describe algorithms that learn from data.

They apply this learning to make predictions about new data. The accuracy of these predictions automatically improves over time as the algorithm processes more data.

What is Cloud Computing

Cloud computing offers a range of services delivered over the internet. These include servers, storage databases, networking software, and analytics intelligence for an enterprise’s growing needs in today’s fast-paced world.

Decision Intelligence

Decision Intelligence is the term given to an essential software category in which comprehensive decision support platforms use machine learning algorithms, data analytics, and decision modelling to solve complex decisions and improve business outcomes.

Low Code & No Code

Low-code platforms allow organisations to build custom apps with minimal coding. Business users who have a basic understanding of programming and can apply business logic while using these low-code development tools, which are often free or available on the cloud.

References

How top tech trends will transform insurance. (2021, September 30). In McKinsey & Company.

Top 8 Insurance Technology Trends & Innovations in 2023. (2022). In Startus Insights.

Advanced Decision Intelligence: How to understand your data better than ever before (2022, October 30). In Dan Fiehn.

Algorithms as a Service: The Future of Computing (2022, July 14). In Dan Fiehn.

7 Types of Nudges to Provide Better Customer Experience (2019, March 19). In Nicereply.

Top 26 Digital Transformation Trends in Insurance in 2023 (2022). In EasySend.

The Amazon Insurance Store is coming soon (2022, October). In Amazon